In my day job, I spend a lot of time talking to patients about relationships. To partners, to children, to coworkers, to themselves, but more frequently, the conversation has shifted to a personal relationship with something too often ignored in the healthcare office…money. And as it turns out, money has a way of impacting just about every other relationship too.

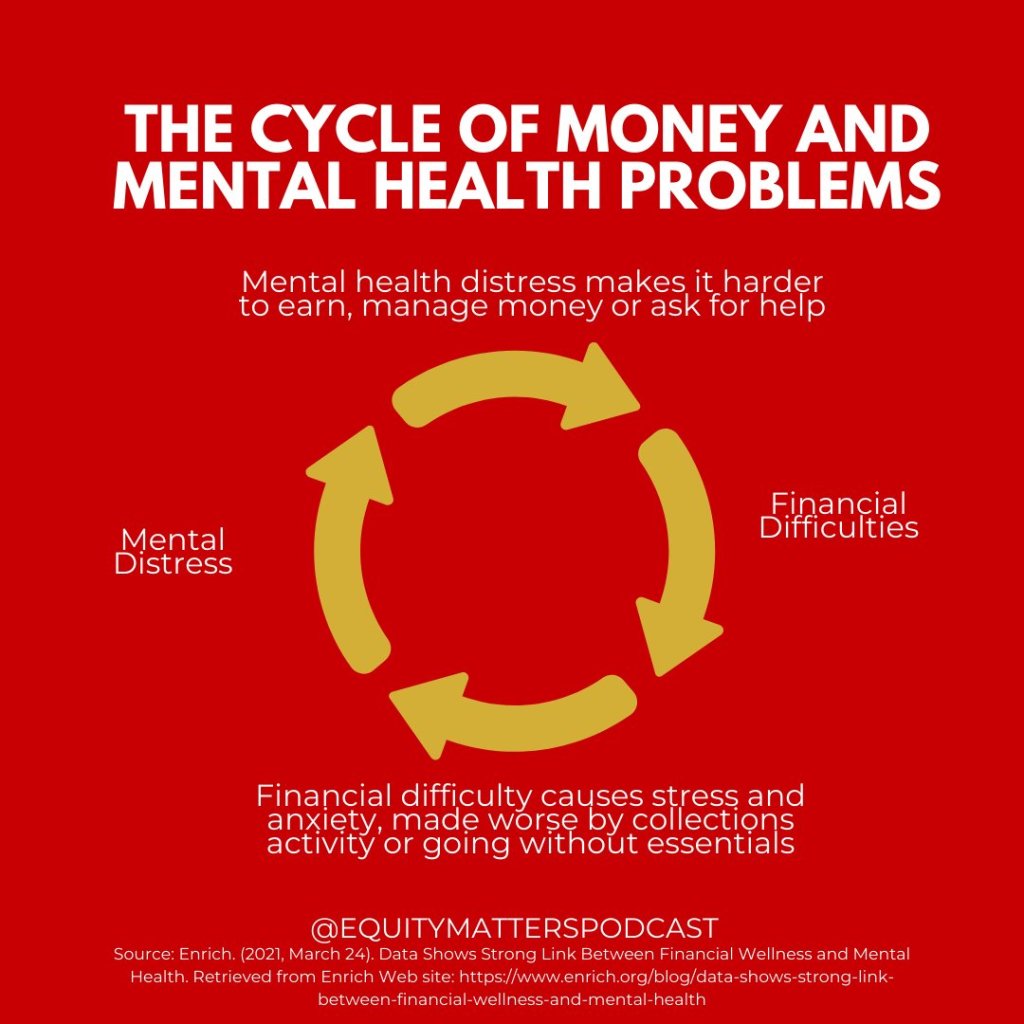

In the wake of inflation, warnings of a looming recession, climbing interest rates, and increasing cost of living, money is officially ‘on the mind’. Nearly two-thirds of Americans are living paycheck-paycheck. Less than half of U.S. adults have enough savings to cover three months of expenses. In my office, financial woes and trepidations frequently top the list of concerns and are often married with feelings of anxiety, shame, envy, fear, denial, avoidance, and despair. Certainly, when in the midst of mental health challenges, there can also be further difficulties in managing finances. According to researchers, financial hardships increases the risk for suicide 20-fold. Apart from the typical guidance on deep breathing, meditation, and positive self-talk, the art of budgeting and financial resourcing seems to be just as paramount to meeting current emotional challenges.

Personal finance was essentially absent in my academic curriculum. While the tide is shifting slowly, personal finance is still today often seen as an elective rather than a standard for youth. While I stood on the valedictorian stage, I had no concept of interest, credit, mortgages, down payments, the mechanics of saving, or investing. I gleefully treated myself to shopping sprees courtesy of my bonus checks from high interest student loans thinking it was somehow free money. I didn’t understand how anybody bought a house believing the only option was to pay outright with cash, and I definitely maxed out my emergency 500.00 limit credit card co-signed by my parents more than a dozen times (mostly on so-called ‘emergency’ take-out). Sorry mom and dad.

When I moved to the wilds of Wyoming in my early 20s for nursing school- states away from the free meals and free laundry home always guaranteed, it was clear that this new concept of adulting necessitated stepping out of my naivete around financial wherewithal. And so, I wandered to a local thrift store, found a used Suze Orman book, and started reading.

Regardless of your feelings about it, our society runs on capitalism. In this model, access to money means access to choice and in my book, access to choice is access to freedom. Not surprisingly, when money is hard to come by, this can leave one feeling trapped, unsafe, and threatened triggering our primal fight, flight, or freeze system conditioned for survival. How much desperation, chronic disease, depression, and anxiety can be traced back to a money trail? To policies keeping people stuck? To a lack of financial literacy? The point is that money and our beliefs surrounding money have huge implications in our health and welfare. We know this, we don’t talk about it enough, and we need to improve on the language and tools around financial well-being.

Some of us are in positions where our financial well-being is dependent on another. I am not going to trample on beliefs or traditions, but the fragility of such a financial ecosystem should be acknowledged as both the provider and dependents can face unique stressors. Regardless of who is bringing home the bigger paycheck, understanding the underpinnings and logistics of financial stewardship is important for all of us nonetheless. Financial stability should not be taken for granted. Power dynamics around finances can turn ugly really quick and are too often a hallmark in abuse and manipulation. I don’t recommend it.

Ultimately, as many concepts in mental health lead to, we come to a point where advocacy is essential to forward progress. We meet the intersection where policies directly impact symptomology. Access to financial capital, opportunity, and financial literacy is no exception. Standardized education around personal finance, affordable housing, enhanced job training programs, affordable pathways to career advancement, & reforming public welfare systems are just a few items worth speaking to. And as we continue to evolve our understanding of holistic wellness, we can’t afford shyness around bringing up the Benjamins.

Thank you for listening, everyone.

With gratitude,

Audry Van Houweling, Owner, She Soars Psychiatry

Sisters & Silverton, Oregon